“It’s not what you don’t know that gets you into trouble, it’s what [some economists] know for sure that just ain’t so.” – Mark Twain

The USA is extremely rich, but we’re borrowing a ton of money to pay the billionaires’ taxes.

That’s crazy.

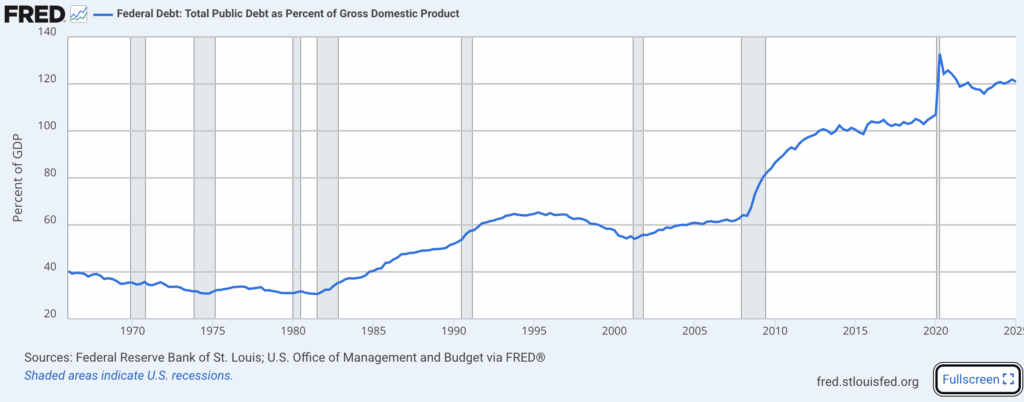

The graph shows debt/GDP, which is a standard way of telling how likely a country is to be able to pay off its debt.

The World Bank says that a country is in trouble if its’ debt/GDP gets over 77%. Ours is over 120%.

Implications and further discussion

The Big Picture

Total Household Net Worth = $160 trillion

Household Net Worth of Half the Population = $4 trillion

The top 10% have 2/3 of the wealth

National Debt = $36 trillion

Gross Domestic Product = $29.3 trillion

Taxes/GDP = 17%

Annual National Budget = $6.8 trillion

National Income = $3.5 trillion

Deficit = $3.3 trillion

Steve Ballmer’s discussion of the US economy.

____________________________________________

The USA is phenomenally rich.

There is no need whatever for Trump’s mean-spirited cost cutting program.

__________________________________________

Middle School Math

Even a small percentage of a quantity that grows without limit also grows without limit.

Applied to National Debt

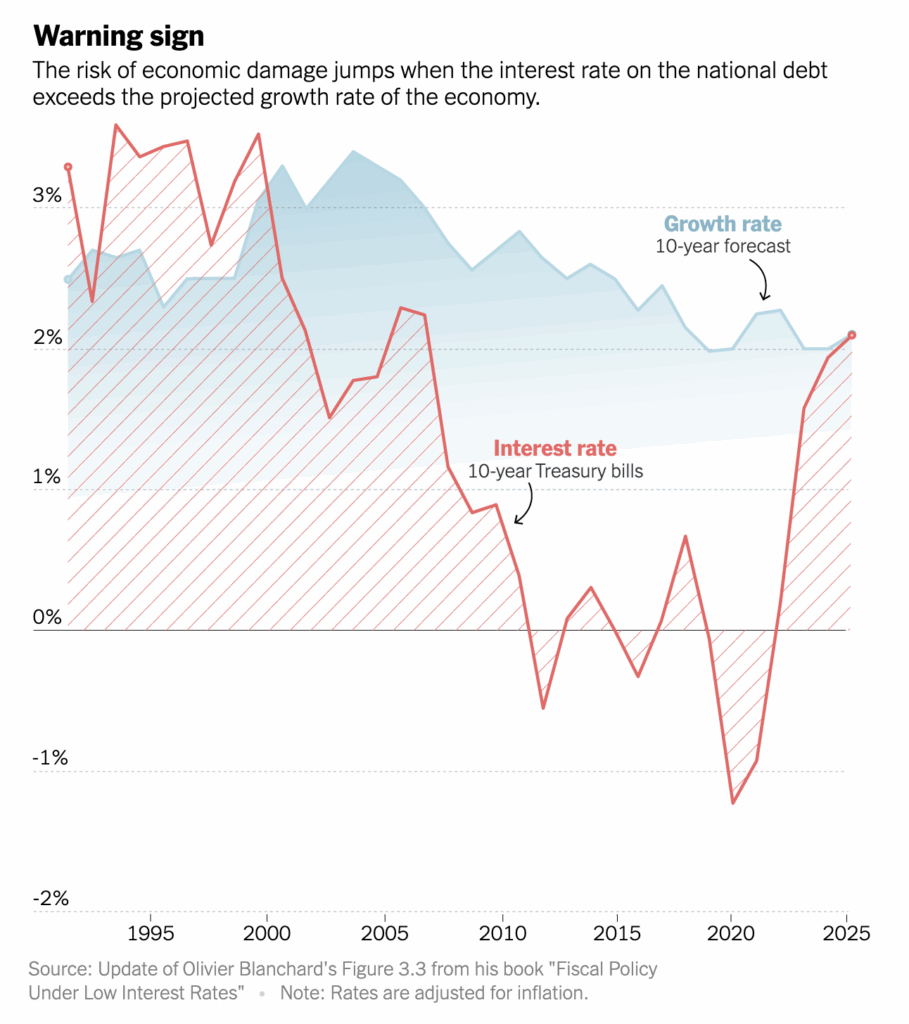

If we keep running huge deficits, the growth in GDP will have to keep pace with the increase in interest. It’s not happening. We can’t depend on it. If it doesn’t in the long term, disaster.

Interest on the current debt already equals the defense budget

So in the long term, big deficits are really bad policy.

In the short term, for specific projects, debt can be justified,

Slightly edited Wikipedia summary of Thomas Piketty’s views.

“Governments should leverage national debt for long-term investments in public goods, such as education, infrastructure, and green energy. The idea is that these investments will pay off in the future, thereby benefiting the economy and society, justifying the debt incurred to finance them. He sees national debt as a tool that can be used to reduce economic disparities, rather than something to be eliminated at all costs.”

Debt should not be used to increase wealth disparity, as it has been in the US for the last 43 years

“Wealth Taxes Over Austerity

(ChatGPT)

Piketty is critical of austerity measures, which often involve cutting public spending to reduce national debt. He argues that austerity policies tend to make iinequality worse and slow down economic growth. Instead, he advocates for wealth taxes and progressive taxation to address inequality and finance government spending, including the management of national debt. Piketty sees wealth taxes as a way to create a more equitable society while allowing for responsible borrowing.

Debt and Globalization

Piketty has also noted that global inequality and the concentration of wealth in a few hands, particularly among the wealthiest individuals and corporations, can make problems related to national debt worse. He suggests that a global tax on wealth could help address these issues and mitigate the challenges posed by national debts, which often have to be managed within a context of uneven global capital flows.

Debt as a Tool of the Wealthy

Piketty warns that the wealthy have the means to benefit from national debt in a way that makes inequality worse. For example, the rich often own large amounts of government bonds, which means they benefit from government borrowing in ways that the general public doesn’t. This, in turn, contributes to the rising wealth gap. To combat this, he proposes that the government should make sure that fiscal policies are more redistributive and that wealth is taxed appropriately.

Conclusion

In essence, Piketty does not view national debt as inherently harmful, especially in an environment where borrowing costs are low and investments are productive. His broader focus is on ensuring that debt is used to reduce inequality, support long-term economic growth, and finance public goods. At the same time, he is critical of policies that prioritize debt reduction at the expense of social investment or the easing of inequality.”

We should only borrow for the public good, not to make the rich richer.

The US is an extremely wealthy nation and can afford to pay off its debt and do a lot more for the planet, the people, and the nation.

Back to “Overthrow rule by Money” email

Back to Flier

Back to Home

Back to National Happiness

Back to Whole Story Email

Back to “Fix the USA” email

Back to Trickle Down

Back to Tariffs

Back to Spending Bill

Back to Income Tax

Back to Timely Aphorisms